Corporate Tax and AML Enforcement in Dubai Company Formation

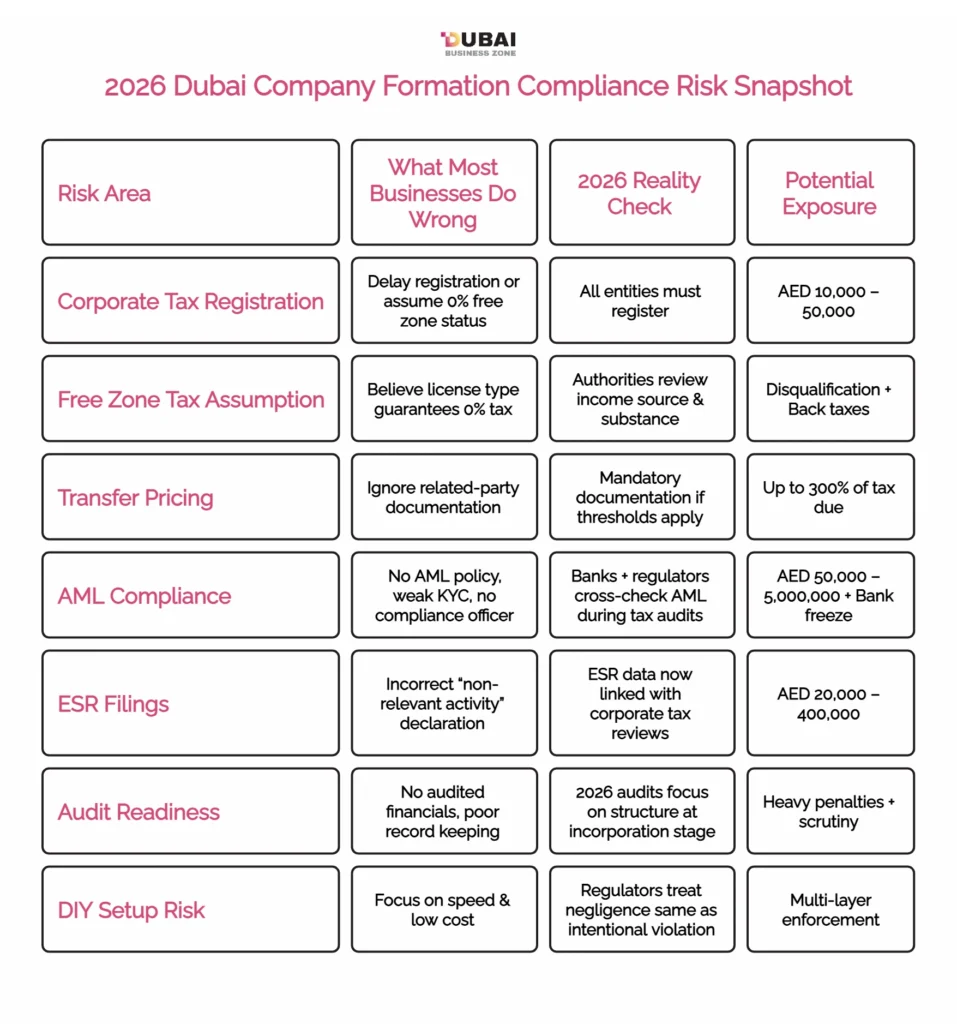

In 2026 corporate tax Dubai company formation is now under the most aggressive enforcement cycle since the UAE has introduced Federal tax reforms.

Authorities comprising UAE banks, Ministry of Economy and Federal Tax Authority are now operating under a linked compliance ecosystem. Companies formed in absence of professional consultants are facing audits failure because of structural failure made at incorporation stage.

Corporate Tax Registration Errors in Business Setup in Dubai

One of the most penalized failures in corporate tax Dubai company formation is regarding delay in registration.

Common corporate tax errors

- Missing FTA registration within the statutory timeline.

- Automatic 0% tax equals assuming free zone.

- Improper selection of “qualifying income” activities.

- No transfer pricing documentation.

- Filing returns without audited financials.

2026 update: Free zone entities are now actively reviewed for substance and income source not only for license type.

Connect with Us to make a business setup choice in your favorite free zones.

AML & ESR Violations Affecting Free Zone Company Formation Dubai

Businesses formed without consultants often ignore AML and ESR until regulators or banks intervene.

AML failures (High-Risk in 2026)

- No AML policy or risk assessment.

- No appointed compliance officer.

- Weak KYC or UBO documentation.

- No Suspicious Transaction Reporting (STR) system.

ESR Violations

- Incorrect “non-relevant activity” declaration.

- No economic substance in UAE.

- Missed ESR notification or report filing.

These violations are responsible for affecting corporate tax Dubai company formation as regulators are now cross-checking AML and ESR data during tax audits.

Real Penalties Faced by Companies Without UAE Compliance Services

| Violation Type | 2026 Penalty Exposure (AED) |

| Corporate tax non-registration | 10,000 – 50,000 |

| Incorrect CT filings | Up to 300% of tax due |

| AML breaches | 50,000 – 5,000,000 |

| ESR non-compliance | 20,000 – 400,000 |

| Bank account closure | Immediate |

Note: Most of these penalties generate from poor initial Dubai company formation decisions.

Role of Dubai Business Consultants in Tax and AML Risk Mitigation

Professional Consultants are known for aligning real operational substance with corporate tax Dubai company formation.

Here is the list of risk control under consultant support:

- Correct tax classification Incorporation.

- AML framework aligned properly under UAE Central Bank.

- Bank compliant license structuring.

- Audit ready documentation from day 1.

- ESR activity mapping and reporting.

Note: This proactive approach supports prevention of penalties instead of reacting to them.

Do check about business networking events – A must read for entrepreneurs in 2026!

Why DIY Company Formation in Dubai Fails Compliance Audits?

DIY and low-cost setup fail due to:

- They prioritize speed over compliance.

- No tax or AML advisory integration.

- No-post license compliance road map.

- No accountability during audits.

In 2026, regulators penalize intentional ignorance the same as negligence

Conclusion: Secure Dubai Company Formation Through Expert Compliance Support

The enforcement landscape of 2026 indicates that corporate tax Dubai company formation in absence of consultants is a financial risk and not a cost-saving strategy. Businesses investing in expert-led compliance achieve audit resilience, long-term operation security and banking stability in the UAE.

Let’s connect with us as we can ensure your company formation without violation of ESR, AML and corporate tax risks in 2026.

Frequently Asked Questions (FAQs)

Is corporate tax registration necessary for all Dubai company formation structures in 2026?

Yes, all the free zone and mainland entities required to register even if they expect 0% tax liability.

What is the biggest corporate tax Dubai company formation mistake in 2026?

Assuming freezone status automatically qualifies for 0% corporate tax in absence of substance validation.

How are AML failures linked to corporate tax Dubai company formation audits?

AML data is cross-checked during tax audits and inconsistencies escalate enforcement actions.

Can ESR non-compliance affect corporate tax Dubai company formation outcomes?

Yes, improper ESR filings can lead to disqualification of tax benefits and cause additional penalties.

Why are consultants critical for corporate tax Dubai company formation in 2026?

Consultants responsibly align tax classifications, ESR reporting, AML controls and banking compliance from day 1.

No comment yet, add your voice below!