The Reality post incorporation compliance Dubai

As per records of 2025 over 70% of UAE business penalties were imposed in the post incorporation compliance Dubai, not during set up. This has turned post-incorporation compliance Dubai as one of the real determinants regarding business survivals required in 2026.

Post-Incorporation Compliance Dubai Requirements for Business Setup in Dubai

Real obligations always start post incorporation compliance Dubai. After issuance of trade license, the UAE law regulates diverse ongoing obligations under Federal Decree Law No. 47 of 2022, Cabinet Resolution No. 58 of 2020 and FTA regulations.

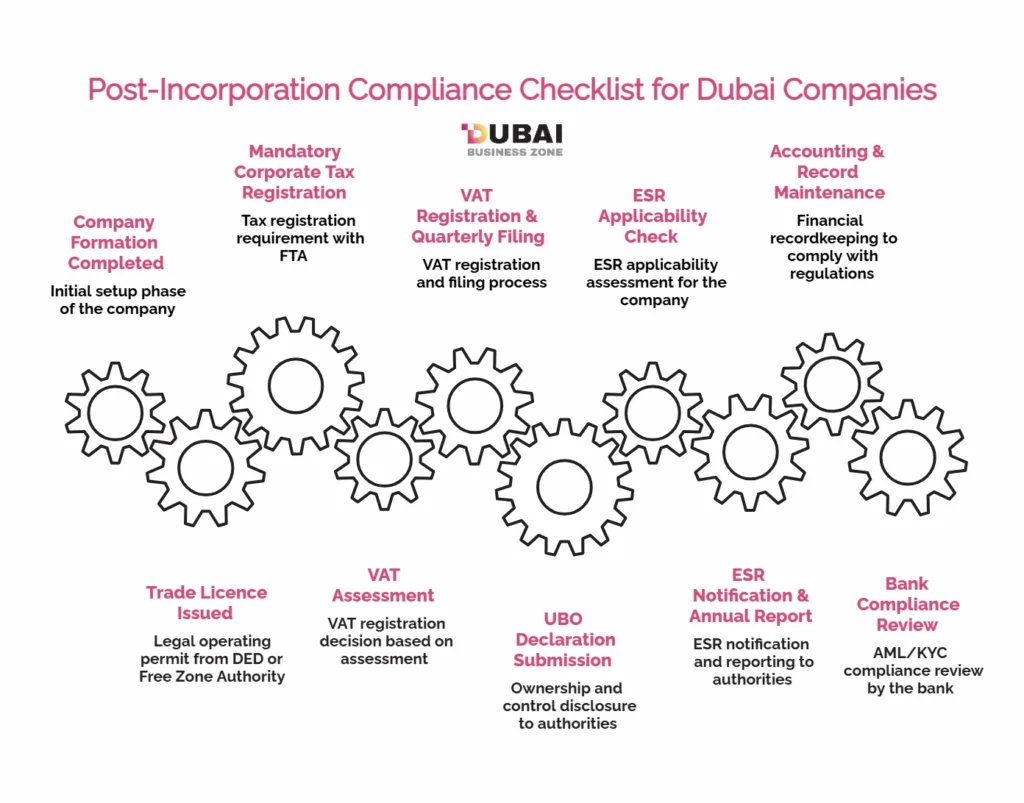

Here are some mandatory compliances needed:

- Trade license renewal.

- Corporate tax registration FTA.

- VAT registration and filing.

- Ultimate Beneficial Owner (UBO) updates.

- Economic Substance Regulations (ESR)

- Accounting Record Maintenance.

Core post incorporation compliance Dubai 2026

| Compliance Area | Governing Authority | Legal Reference |

| Corporate Tax | Federal Tax Authority (FTA) | Decree-Law No. 47 |

| VAT | FTA | Decree-Law No. 8 |

| ESR | Ministry of Finance | Cabinet Res. 57 |

| UBO | DED / Free Zones | Cabinet Res. 58 |

| Licence Renewal | DED / Free Zone | Local Regulations |

Readers also take interest in learning about family sponsorship — Latest reader choice!

VAT, Corporate Tax & ESR Obligations post incorporation compliance Dubai

As of current update taxation is not dominating post incorporation compliance Dubai.

Here are some current updates you need to learn:

- Corporate tax of 9% on profits above AED 375,000.

- VAT: 5% necessary above AED 375,000 turnover.

- ESR applies to 9 regulated activities.

Moreover, FTA data highlights 41% SME penalties mainly regarding late registration and incorrect filings. Here is a Tax & reporting threshold for you:

| Obligation | Threshold | Filing Frequency |

| Corporate Tax | AED 375,000 profit | Annual |

| VAT | AED 375,000 revenue | Quarterly |

| ESR | Relevant activity | Annual |

| Accounting Records | All companies | 5 years |

Readers also are interested in — UAE Banking Reforms 2026: Why Business Accounts Fail After Free Zone Company Formation

Banking, Visa Renewals and Structuring Risks Without Consultants

Make sure you do not miss compliance, otherwise it can freeze your operations. Under CB-UAE AML Guidelines 2025-26 banks may freeze accounts for:

- Missing tax filings.

- Inconsistent license activity.

- Weak source-of-funds documentation.

Visa renewal under MOHRE is also blocked if license or tax status is non-compliant.

How Dubai Business Consultants Support Post-Setup Growth?

Compliance in 2026 is actually protection in the post incorporation compliance Dubai. Here consultants are responsible for managing:

- ESR and tax filing.

- Banking ready documentation.

- Regulatory change tracking.

- License and Visa renewals.

This actually minimizes operational challenges and enhances bank confidence.

Consequences of Ignoring Post-Incorporation UAE Compliance Services

Penalties are the only start in terms of consequences in failing post incorporation compliance Dubai. Non-compliance leads to:

- Fines of around AED 50,000 per violation.

- License suspension.

- Bank account closure.

- Visa cancellation.

Conclusion: Long-Term Success Beyond Business Setup in Dubai

In 2026, post incorporation compliance Dubai is a mandatory part and not just an option. It serves as a foundation for long term business survival. Therefore, it must be understood that setup is temporary but the post incorporation compliance Dubai is mandatory.

Let’s connect with us for a more secure service!

Frequently Asked Questions (FAQs)

Is post incorporation compliance Dubai mandatory for free zone companies?

Yes, free zone companies must comply with tax, UBO, VAT, ESR and license renewal.

Is corporate tax registration required even with zero revenue?

Yes, all UAE companies need to register with FTA in 2026, even if filing a nil return.

Can missing ESR notification cause penalties without income?

Yes, ESR notification is necessary depending on licence activities and not the income.

Can banks freeze accounts for compliance failure?

Yes, banks may restrict accounts under CB-UAE AML rules for non-compliance.

Are accounting records legally required for SMEs?

Yes, UAE law requires all companies to maintain records for at least 5 years.

No comment yet, add your voice below!