Dubai Airport Free Zone Requirements for Company Setup: DAFZA hosts 2000+ multinational companies that contribute billions to Dubai’s non-oil GDP. In 2026, compliance scrutiny has increased due to:

- UAE corporate tax framework.

- Enhanced AML and UBO transparency.

- Global banking due diligence alignment.

Meeting company formation in Dubai Airport free zone requirements correctly ensure quick approval and smoother banking.

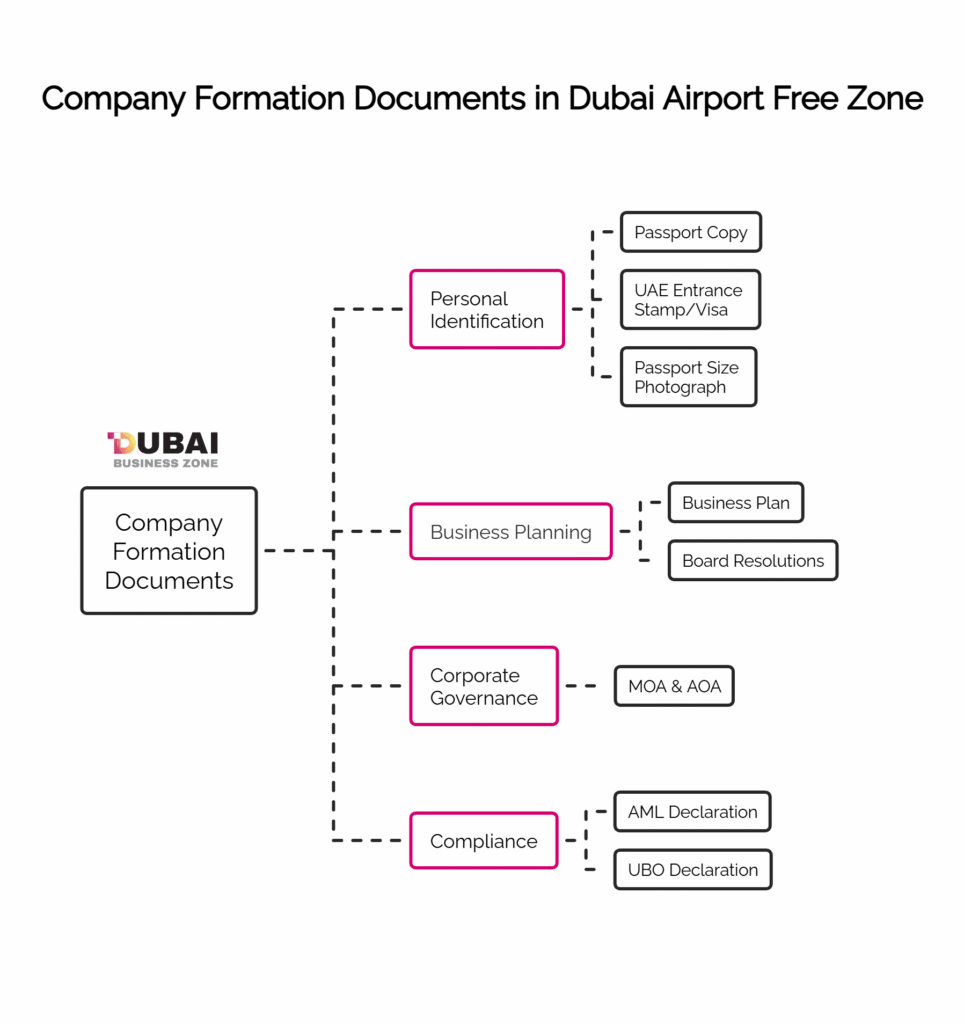

Documents for company formation in Dubai Airport Free Zone (DAFZ)

Mandatory documents 2026:

- Passport Copy of all directors and shareholders.

- UAE entrance stamp or visa page.

- Recent passport size photograph with white background.

- Business plan necessary for logistics Technology Aviation and trading.

- Board resolutions for corporate shareholders.

- Memorandum and Articles of Association (MOA & AOA)

- AML and compliance declaration.

- Ultimate Beneficial Owner (UBO) declaration.

Also learn about the business activities permitted in DAFZA.

Eligibility regarding company formation in Dubai airport free zone requirements

DAFZA allows 100% foreign ownership, however there are eligibility criteria for company formation in Dubai Airport free zone.

Who can apply for it?

- Individual entrepreneurs.

- Foreign companies (branch or subsidiary)

- Holding companies.

- Startups in aviation, IT, pharma, logistics, trading and aviation.

Who needs extra approval?

- Financial Services.

- Aviation-restricted activities.

- Defence or dual-use goods.

Shareholder rules for company formation in Dubai airport free zone requirements

DAFZA maintains strict shareholder governance in comparison to low cost-free zones. Here is a quick breakdown:

| Entity Type | Shareholders | Notes (2026) |

| FZE | 1 shareholder | Individual or corporate |

| FZCO | 2–50 shareholders | UBO disclosure mandatory |

| Branch | Parent company | No share capital |

UBO Rule 2026:

Any individual owning 25% or more must be declared under UAE Cabinet Resolution compliance.

Interested readers are also searching for available licenses in DAFZA.

Minimum capital update for company formation in Dubai airport free zone requirements

The most demanding company formation in Dubai Airport free zone requirements is capital.

Capital Structure 2026

| Entity Type | Minimum Capital |

| FZE / FZCO | AED 500,000 (standard) |

| Branch Office | Not required |

Note: Capital does not need to be deposited immediately but required to be stated in MOA.

Approval timelines for company formation in Dubai airport free zone requirements

DAFZA approvals get structured but efficient when documents are appropriate.

Here is the typical timeline (2026):

- Initial approval within 3 to 5 working days.

- Legal documentation and lease signing within 5 to 7 days.

- License issuance under 7 to 14 working days.

- Visa and establishment card under 5 to 10 days.

Total average setup time: 14 to 21 working days.

Conclusion

Fulfilling company formation in Dubai Airport free zone requirements in 2026 refers to strategic compliance planning. DAFZA is best for companies expecting credibility, long term scalability and logistic advantage but it is not a shortcut for free zones.

Let’s connect with us to start your DAFZA business setup.

Frequently Asked Questions (FAQs)

Is 100% foreign ownership allowed in DAFZA?

Yes, 100% foreign ownership is permitted without involvement of local sponsor

Is a business plan compulsory in DAFZA?

Yes, for logistics aviation trading and regulated activities a business plan is mandatory in DAFZA.

Is a physical office necessary for DAFZA in 2026?

Yes, DAFZA does not allow virtual or zero office licenses.

Can I open a bank account easily in DAFZA?

Strong AML, UBO and activity clarity and justification is necessary.

Is DAFZA suitable for startups?

DAFZA is best for company scaling and funded startups and not for ultra-low budget founders.

No comment yet, add your voice below!