UAE Business Compliance Reforms 2026 Impacting Business Setup in Dubai

The UAE business compliance reforms 2026 have marked a decisive transformation from lenient on boarding to one strict post-incorporation enforcement.

Now the authorities are actively penalizing organizations that completed Dubai company formation without structured compliance planning. UBO, AML, ESR and corporate tax are no longer procedural but they are audited, cross-checked and enforced online across free zones and the mainland.

Businesses that used to rely on low cost or DIY business set up in Dubai are now facing fines, banking exits and license suspensions.

What Changed in 2026 for UAE Compliance Services and Company Formation in Dubai?

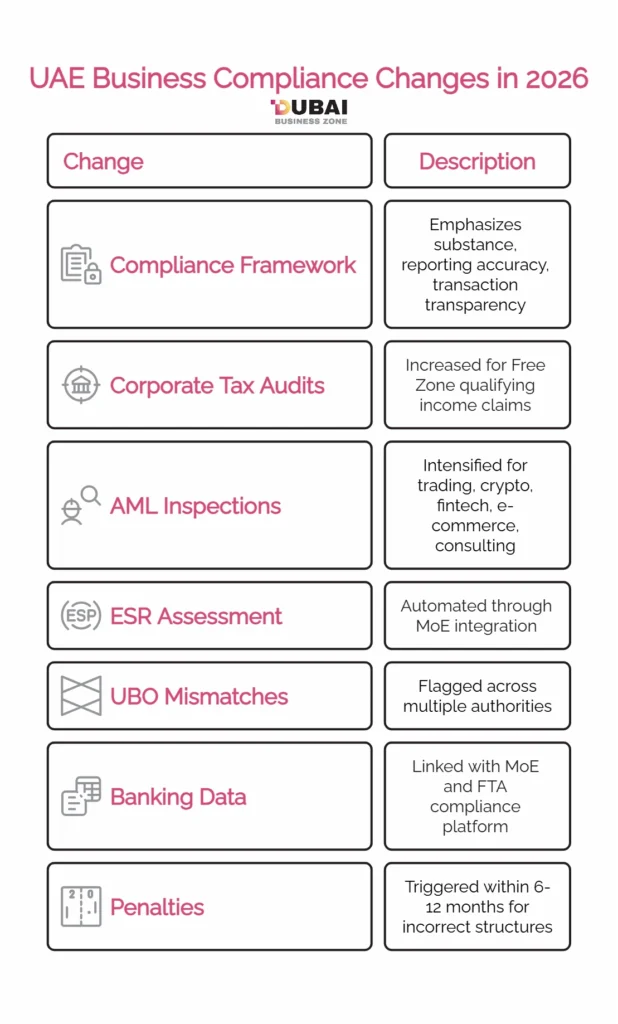

In 2026, compliance framework emphasizes on substance, reporting accuracy and transaction transparency.

Enforcement changes in 2026:

- Corporate tax audits increased to Free Zone “qualifying income” claims.

- AML inspection intensified for trading, crypto, fintech, e-commerce and consulting.

- ESR assessment automated through MoE integration.

- UBO mismatches flagged across multiple authorities.

- Banking data linked with MoE and FTA compliance platform.

As an outcome, incorrect Dubai company formation structures now trigger penalties within 6 to 12 months rather than years.

Save your business from heavy penalties Get in touch with Us.

Common Compliance Failures in Business Setup in Dubai Triggering Penalties

Improper planned setups are the main reason companies fail under UAE business compliance reforms 2026.

High-risk failures:

- Selecting license activities misaligned with real operations.

- Missing corporate tax registration within statutory timelines.

- No AML risk assessment or compliance officer appointment.

- Incorrect free zone tax treatment assumptions.

- Failure to file ESR notification and reports.

These issues are especially common in DIY company formation in Dubai.

AML, ESR & Corporate Tax Risks for Dubai Company Formation

The most penalized areas in 2026 comprises corporate tax Dubai company formation, ESR non-compliance and AML breaches.

Key regulatory risks

- Corporate tax: miss classification of qualifying income — tax+penalties.

- AML: No STR reporting, no KYC and no source of funds documentation.

- ESR: Declaring “non-relevant activity” incorrectly.

Penalty snapshot (2026)

| Violation Area | Penalty Range (AED) |

| Corporate Tax non-registration | 10,000 – 50,000 |

| Incorrect CT filings | Up to 300% of tax due |

| AML failures | 50,000 – 5,000,000 |

| ESR non-compliance | 20,000 – 400,000 |

| License suspension | Immediate |

How Dubai Business Consultants Prevent Costly Compliance Mistakes?

Professional UAE compliance services now emphasize on pre-emptive structuring and not post-penalty recovery.

Consultant led safeguards

- Correct corporate tax Dubai company formation classification.

- AML frameworks aligned with Central Bank standards.

- ESR activity mapping and reporting.

- Banking aligned license structuring.

- Ongoing compliance calendars and audit readiness.

How about Remote vs Office based business setup — It’s in trend in 2026!

Penalty Examples Affecting Free Zone and Mainland Business Setup in Dubai

Recent enforcement patterns indicate:

- Free zone companies losing 0% tax status because of substance failures.

- Mainland consultancies are getting blocked by banks for AML non-compliance.

- Trading businesses fined for UBO inconsistencies across authorities.

Such penalties grow directly from poor Dubai company formation without consultants.

Conclusion: Why Consultant-Led Business Setup in Dubai Is No Longer Optional

The enforcement reality of UAE business compliance reforms 2026 highlight that consultant-led Dubai company formation is no longer optional but a risk protection. Businesses that ignore structured UAE compliance services suffer operational shut down banking exclusion and financial penalties.

Contrarily, companies building under compliance in terms of sustainability, audit-resilience and long-term scalability in the UAE are gifted with secure Dubai company formation in 2026.

Let’s connect with us as we can ensure your business setup prevention from penalty risks in 2026.

Frequently Asked Questions (FAQs)

What can be the timeline for penalties triggering after company setup in UAE?

Penalties can be issued under 3 to 6 months if ESR, AML or corporate tax registration are missed.

Are freezone companies fully protected under UAE business compliance reforms 2026?

No, free zone companies are equally audited, particularly in terms of substance, AML compliance and qualifying income.

Does incorrect license activities selection cause compliance penalties in 2026?

Yes, mismatched activities are flagged during banking, AML and tax reviews that cause fines or license suspension.

How do UAE business compliance reforms 2026 affect bank account continuity?

Banks now freeze or exit accounts when FTA, ESR or AML non-compliance is detected.

Can penalties be avoided after incorporation under UAE business compliance reforms 2026?

Only if corrective filing and disclosures are completed before an audit notice is issued.