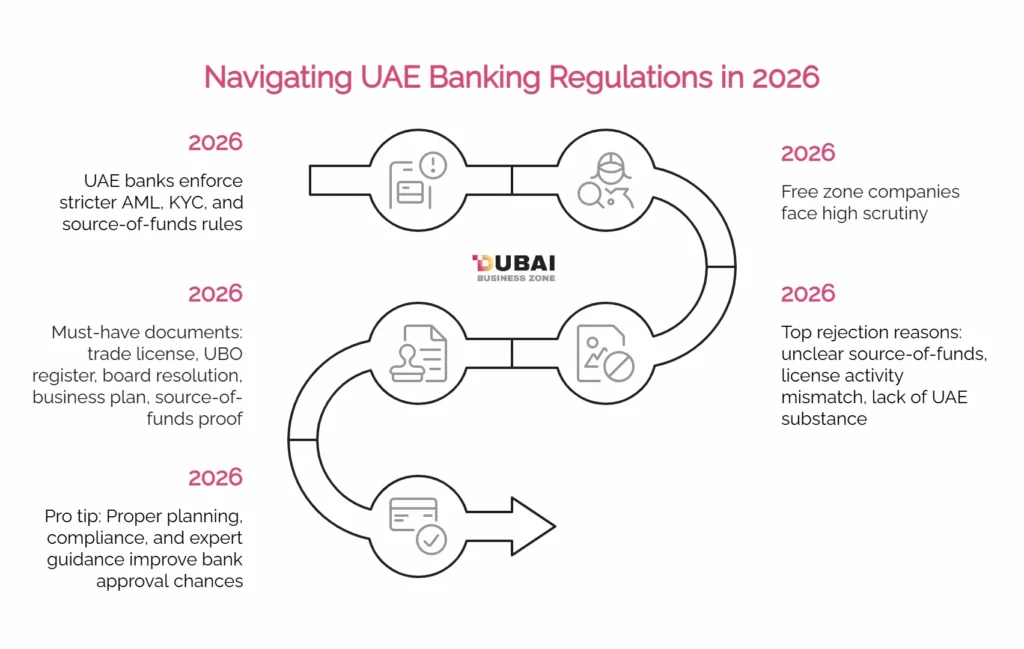

In UAE banking reforms 2026, bank rejection is a clear sign of silently killing a business. Following FATF-aligned reforms, it is observed that more than 45% of new UAE companies have experienced banking delays in 2025.

New KYC and Source-of-Funds Rules Affecting Dubai Company Formation

Under CB-UAE AML & KYC framework 2025, banks demand:

- Clear UBO disclosure.

- Source-of-funds evidence.

- Operational substance.

Banking Rejection Risks After Free Zone Company Formation Dubai

Free zone entities are flagged due to:

- Offshore shareholders.

- Flexi-desk addresses.

- Generic activities.

Here are some common bank rejection triggers as well. Take a look:

| Trigger | Risk Level |

| No UAE substance | High |

| Weak source-of-funds | High |

| Activity mismatch | Medium |

| Missing tax registration | High |

Common Structuring Errors Made During Business Setup in Dubai

Most of the time failures start at the business setup point. Here are some errors that must be checked under UAE banking reforms 2026:

- License activity not matching cash flow.

- No compliance roadmap.

- Poor documentation quality.

Remote vs office-based setup – Make a smart choice by reading this!

How Dubai Business Consultants Improve Bank Account Approval?

You might have heard that preparation beats persuasion. Here are ways Dubai business consultants can enhance bank approval.

- Aligning license to the operations.

- Preparation of AML compliant files.

- Structure ownership transparently.

Compliance Documents Banks Expect from Dubai Companies in 2026

Dubai companies must carry these documents mandatorily under UAE banking reforms 2026.

| Document | Purpose |

| Trade Licence | Legal existence |

| UBO Register | Ownership clarity |

| Board Resolution | Authority proof |

| Source-of-Funds | AML compliance |

| Business Plan | Activity validation |

Conclusion: Align Banking Strategy with Business Setup in Dubai Under UAE banking reforms 2026, by means of planning and not by hope. It’s your turn to get your banking success through experts.

Let’s connect with us to get your banking strategy properly aligned with business setup.

Frequently Asked Questions (FAQs)

Why are UAE banks rejecting more business accounts in 2026?

Due to strict FATF-aligned KYC, AML and source-of-funds requirements.

Are free zone companies more affected by banking reforms?

Yes, banks apply higher scrutiny to free zone structures with limited substance.

Is corporate tax registration required for bank account opening?

Many banks now request FTA Corporate tax registration during onboarding.

What is the top reason for bank account rejection?

Unclear source of funds documentation and licence activity mismatch.

Can rejected Bank applications be fixed?

Yes, but only after restructuring compliance and documentation.

No comment yet, add your voice below!